Market Cap Explained

Market capitalization is one of the most commonly used metrics in cryptocurrency markets, yet it is often misunderstood. This guide explains what market cap means, how it is calculated, and where it can be misleading.

What Is Market Capitalization?

Market capitalization, or market cap, represents the total value of a cryptocurrency's circulating supply based on its current price.

The basic formula is simple:

Market Cap = Price * Circulating Supply

Market cap is not the amount of money invested. It is a snapshot of how the market values a crypto asset at a given moment.

Market capitalization is calculated using price and circulating supply.

Why Market Cap Is Used

Market cap helps compare cryptocurrencies of different prices and supply sizes. A coin priced at $10 is not cheaper than a coin priced at $1,000 unless supply is considered.

This metric allows investors to understand relative size and dominance across the market.

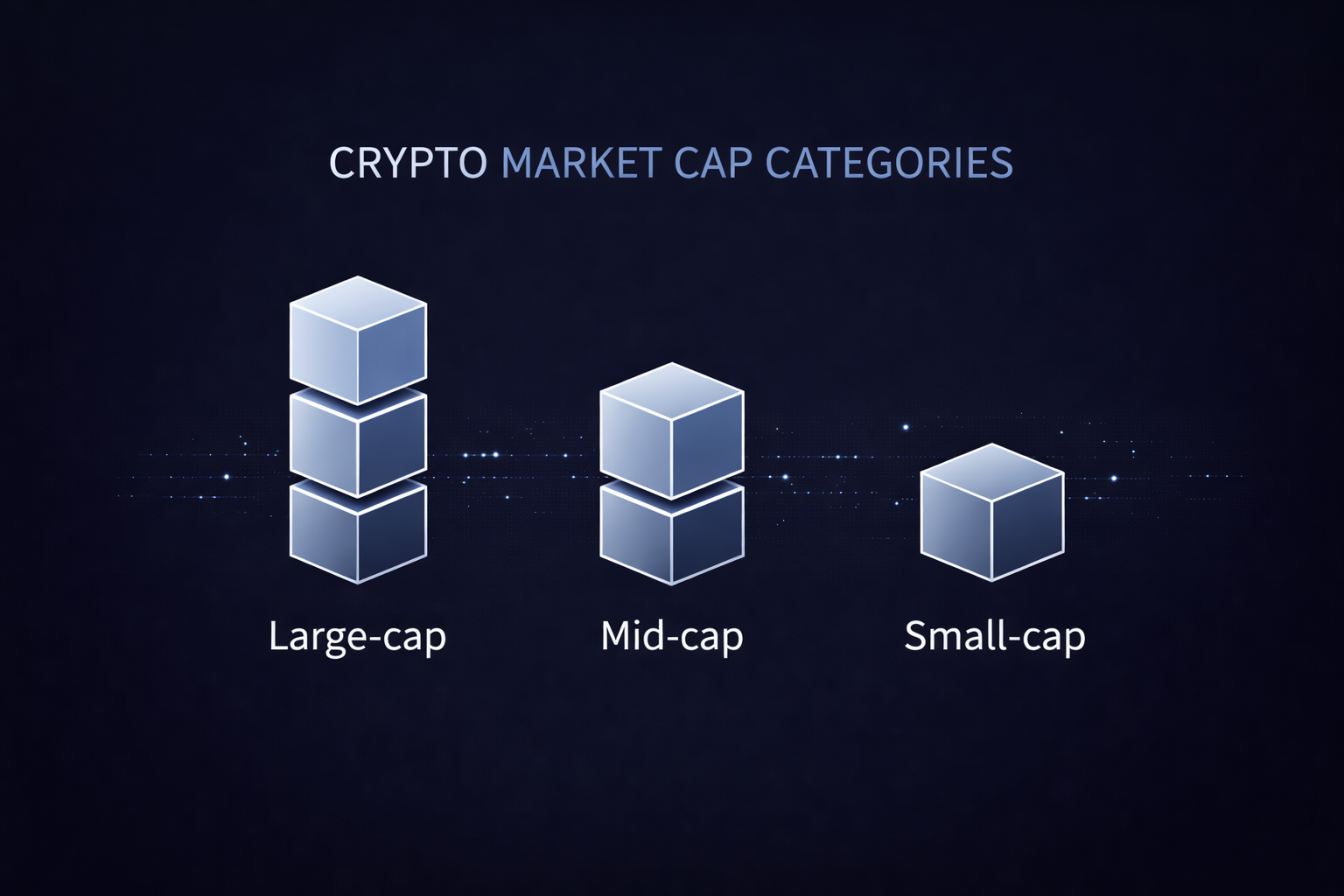

Cryptocurrencies are often grouped by market cap size.

Market Cap Categories

- Large-cap: Established networks with higher stability

- Mid-cap: Growing projects with moderate adoption

- Small-cap: Early-stage or niche projects with higher risk

Larger market cap assets tend to be less volatile, while smaller ones may offer higher potential returns along with higher risk.

Different supply types affect market capitalization calculations.

What Market Cap Does Not Show

Market cap alone does not reflect liquidity, trading volume, token distribution, real-world usage, or network security.

A crypto asset can appear large by market cap even if very few tokens are actively traded.

Common Market Cap Misunderstandings

- Assuming high market cap means low risk

- Ignoring token unlock schedules

- Comparing coins without supply context

- Treating market cap as invested money

Key Takeaways

- Market cap compares size, not quality

- Price alone is misleading

- Supply structure matters

- Market cap should be used with other metrics

Disclaimer: This content is for educational purposes only and does not constitute financial advice.

To see how real-world events impact crypto markets, explore our crypto news explanations.